Gore functions with the Trader shopper who usually buys houses at auction, which he fixes up and sells the subsequent year. That enables him to bypass a lot of the typical transaction fees, lowering his charges to 1%-two% of the acquisition price tag.

Under most circumstances, there isn't any lawful limits preventing you from selling your property after proudly owning it for under a year. In reality, when you desired to, you could potentially set your private home again in the marketplace immediately after closing on it.

Certainly, the biggest problem on the thoughts is: Has the housing market held potent ample to actually see your home enjoy in worth therefore you won’t shed money?

Microsoft and DuckDuckGo have partnered to deliver a lookup Option that delivers applicable commercials to you although safeguarding your privacy. If you click a Microsoft-provided ad, you will end up redirected into the advertiser’s landing web site through Microsoft Promoting’s System.

Probably your financial circumstance has transformed, and you simply’re no more able to keep up with all your mortgage loan repayments. Or perhaps your home taxes have improved to the diploma that proudly owning the house is no longer fiscally valuable.

By selling after a year or significantly less, you’re liable to incur costs which include closing charges, shifting expenses, and money gains.

Whilst company website You can not Get the closing costs all the way down to almost nothing, one way to reduce them somewhat is by utilizing a cost-free low Fee services like Clever. In this instance, you'd preserve around $six,000 in real estate agent service fees!

Indeed, as soon as you will be the legal operator of your own home, you can sell it after possessing it in the future. Nevertheless, in many conditions, This may be a highly-priced decision as a result of minimal length of time you’ve owned the home. You’ll most likely face quite a few out-of-pocket expenses, for instance:

Sure. HomeGo functions with wholesalers trying to sell various houses in Dallas, or investors/landlords planning to sell residences they want to income out of. Whether you’re wanting to sell a single house or several homes, HomeGo has ordered billions of pounds click this link in properties and may help!

Absolutely! Selling your house after two years provides time to construct equity, especially when area residence values are increasing steadily.

You may lawfully sell your house the pretty following day of the purchase. On the other hand, there are actually monetary and tax penalties which you may face:

Level of the gain: Should you owned and lived in the house for 2 of the past 5 years prior to the sale and so are just one person, then $250,000 of earnings is usually regarded tax-totally free.

Following, You must ensure that you can find the money for to sell your home. At closing, you'll have to read this article pay back your remaining home finance loan harmony, in addition to all other closing expenses (typically about 10% in the sale rate).

Seller Closing Fees: All the things You have to know: Once you sell your house, you'll likely pay close to 10% on the sale cost in closing expenditures. Here's an entire manual to the charges you could expect to pay for, in addition to tricks for conserving cash.

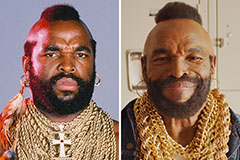

Mr. T Then & Now!

Mr. T Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!